- Home

- Strategies

- Cryptocurrency

Summary - as of March 31, 2018

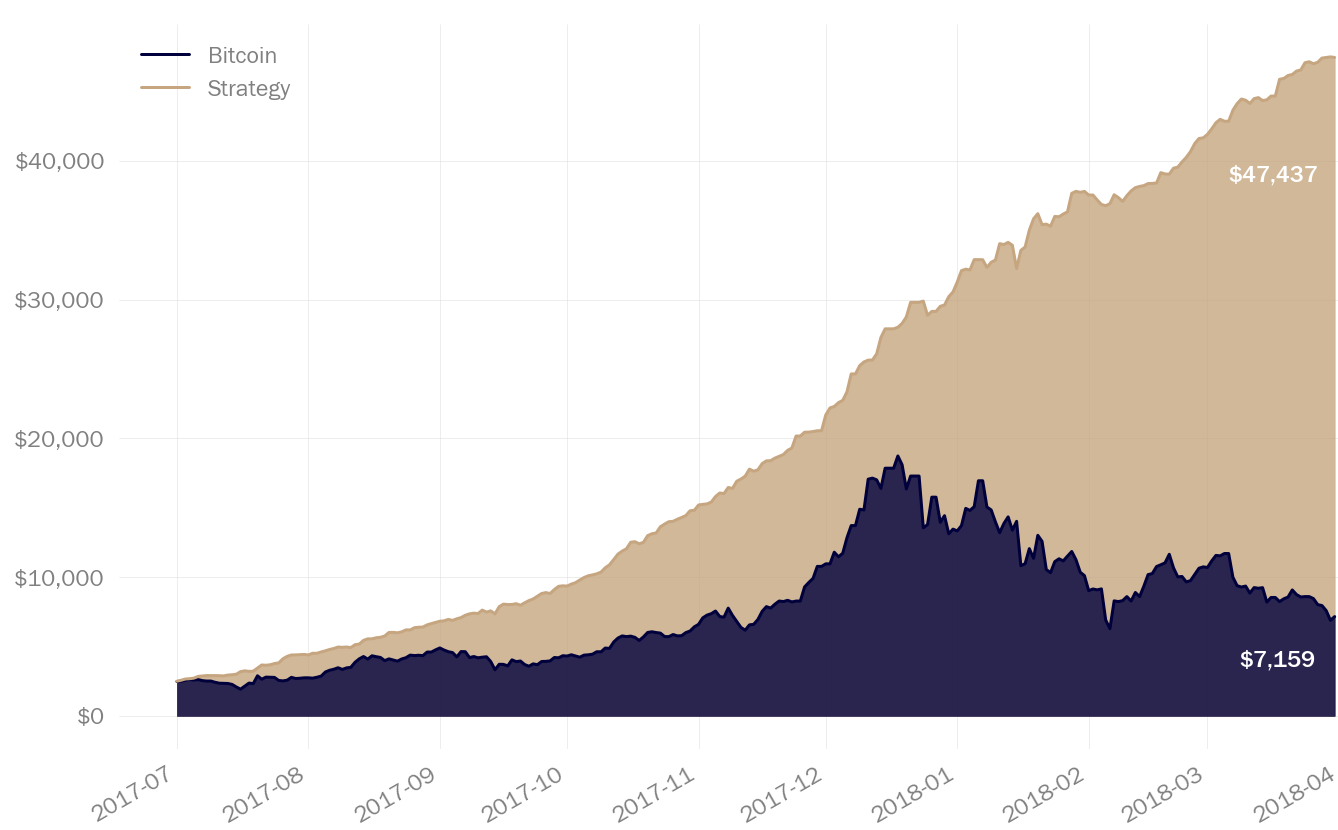

Our Tactical Crypto strategy was designed to take advantage of intraday momentum-backed swings in cryptocurrency prices. Since inception, the strategy has out-performed Bitcoin’s overall returns by a factor of 10*, while lowering both the volatility and drawdowns by more than 90%, compared to Bitcoin.

“Since inception in 2017, the strategy achieved a total return of 1,794.4%, with 2018's Q1 returns set at 55.3%, compared to Bitcoin's -46.8%.”

The strategy is 100% systematic, with all decisions made by a computer algorithm using quantitative models for capital allocation.

Please contact us for further information regarding the strategy, including a complete factsheet and trade log.

BITCOIN VS STRATEGY **

* 1,794.4% total return vs Bitcoin's 188.8% (x9.5)

** Pro-forma, net of fees

HIGHLIGHTS

- Attractive risk-adjusted returns compared to buy-and-hold

- Trading both long and short provides more opportunities than "vanilla BTC"

- Protects investors capital during market downturns

| Metric | Strategy | BTC |

|---|---|---|

| YTD Returns | 55.3% | -46.8% |

| Total Returns | 1,784.4% | 188.8% |

| Sharpe Ratio | 10.71 | 1.49 |

| Standard Deviation | 1.62% | 6.13% |

| Downside Deviation | 0.48% | 3.67%% |

| Max Drawdown | 5.51% | 66.43% |

| Longest Drawdown | 10 | 78 (ongoing) |

| Alpha | 0.27 | - |

| Beta | 0.04 | - |

| Correlation | 0.02 | - |