- Home

- Strategies

- US

Summary - as of March 31, 2018

This low-frequency strategy is designed to take advantage of market seasonality in different securities and catch short-term trends caused by momentum in price. The strategy achieves attractive risk-adjusted returns and capital appreciation.

“The main goals of the strategy is to safeguard investors capital during periods of severe market stress, such as the market downturn of 2008 and the volatility spike of February 2018.”

To achieve this goal, the strategy’s algorithm allocates capital to equity index ETFs or Treasury securities when attractive investment opportunities are limited and may even flatten all positions during extreme market stress.

The strategy is 100% systematic, with all decisions made by a computer algorithm using quantitative models for capital allocation.

Please contact us for further information regarding the strategy, including a complete factsheet and trade log.

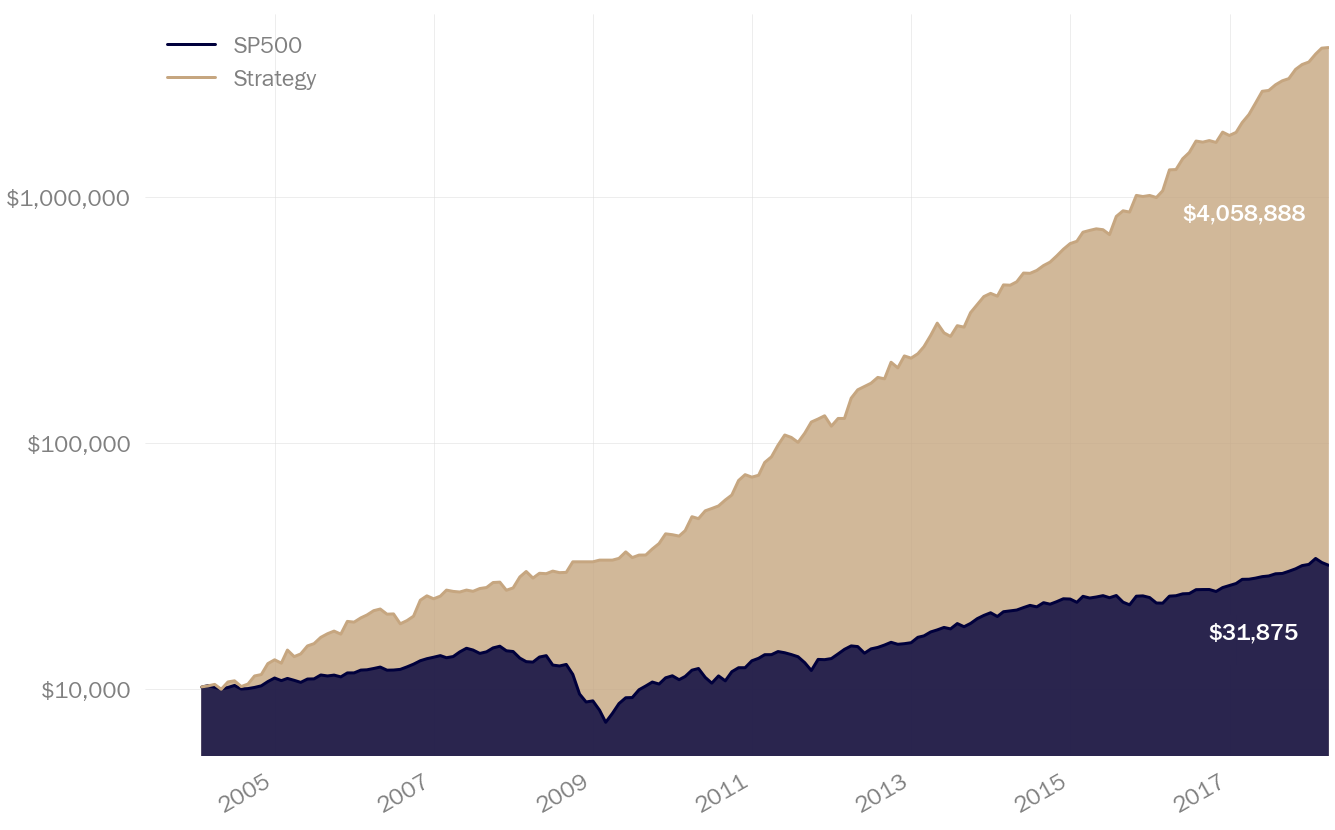

GROWTH OF $10,000 INVESTMENT *

** Pro-forma, net of fees

HIGHLIGHTS

- Flexibility to reduce equity exposure during market stress

- Tactically increases equity exposure to suit market conditions

- Protects capital during market downturns

| Metric | Strategy | SP500 |

|---|---|---|

| YTD Returns | 16.35% | -1.83% |

| Total Returns | 31,456.9% | 195.01% |

| CAGR% | 57.78% | 8.57% |

| Sharpe Ratio | 2.16 | 0.53 |

| Standard Deviation | 21.5% | 18.9% |

| Max Drawdown | 14.7% | 55.2% |

| Longest Drawdown | 120 | 1,170 |

| Alpha | 0.44 | - |

| Beta | 0.26 | - |

| Correlation | 0.26 | - |